msg.Greenfactory

The CO2 emission trading and product development portal for the insurance industry

Vehicle market in a state of upheaval – Opportunities for insurance companies and end customers

Driven by the high fuel prices, state support and the demand for more sustainability, more and more vehicle owners are swapping their combustion-powered vehicles for modern electric vehicles. This poses a variety of challenges for the insurance industry, as entire motor vehicle fleets are set to undergo fundamental changes in the near future.

With msg.GREENfactory, we are supporting the insurance industry with a product development portal designed for sustainability with connected direct emissions trading. This creates additional potential for premium and product optimization in the motor vehicle market.

What we offer:

- The development and implementation of tailored and sustainable product ideas

- The overall orchestration and handling of emissions quota trading (GHG quota trading) for your e-vehicle fleet

- Attractive returns via direct trading through a fixed “quota buyer network”

- Transfer of the quota revenue to the insurance industry (such as for premium optimization of vehicle tariffs for your electric vehicle customers)

Do you have any questions?

The number of electric vehicle fleets is growing rapidly in Germany.

Up to 20 million electric cars are forecast by 2030.

This growth is being spurred by purchase incentives from the German government and industry;

for example, the environmental bonus, the innovation premium and the manufacturer bonus.

Challenges for the insurance industry – and their solution

1. Observation

- Increased transparency through comparison portals

- Cost-conscious customers

- Insurance offers from non-industry vendors (vehicle manufacturers)

2. Impact

- Loss of more and more customer touchpoints

- Reduced market presence

- High competitive pressure

3. Reaction

- Increased attractiveness of insurance tariffs

- Without high additional costs or higher IT effort

- Increasing the customer benefit

- Customer demand for more sustainability

4. Solution: msg.GREENfactory

- Premium optimization of more than 40%

- White label tools for easy integration into existing systems

- Enhanced customer service

- Support for activities to reduce CO2 emissions

- Reliable partner with high insurance know-how and expertise

The msg.GREENfactory process chain

Money from the state for sustainable insurance solutions? msg.GREENfactory makes it possible. Beneficiaries:

- Lower insurance premiums

- Simplified contract conclusion

- Annually recurring premium optimization

- Trend toward rising GHG quota revenue

- Attractive vehicle insurance tariffs with premium discounts

- Using state supported allowance options

- Annually recurring optimization potentials

- Cross selling by splitting GHG quota revenue

- More customer benefit and service

- Closer customer relationship

- Positive public image

- Reduction of the ecological footprint as assistance to reduce CO2 emissions

Our value proposition to insurers

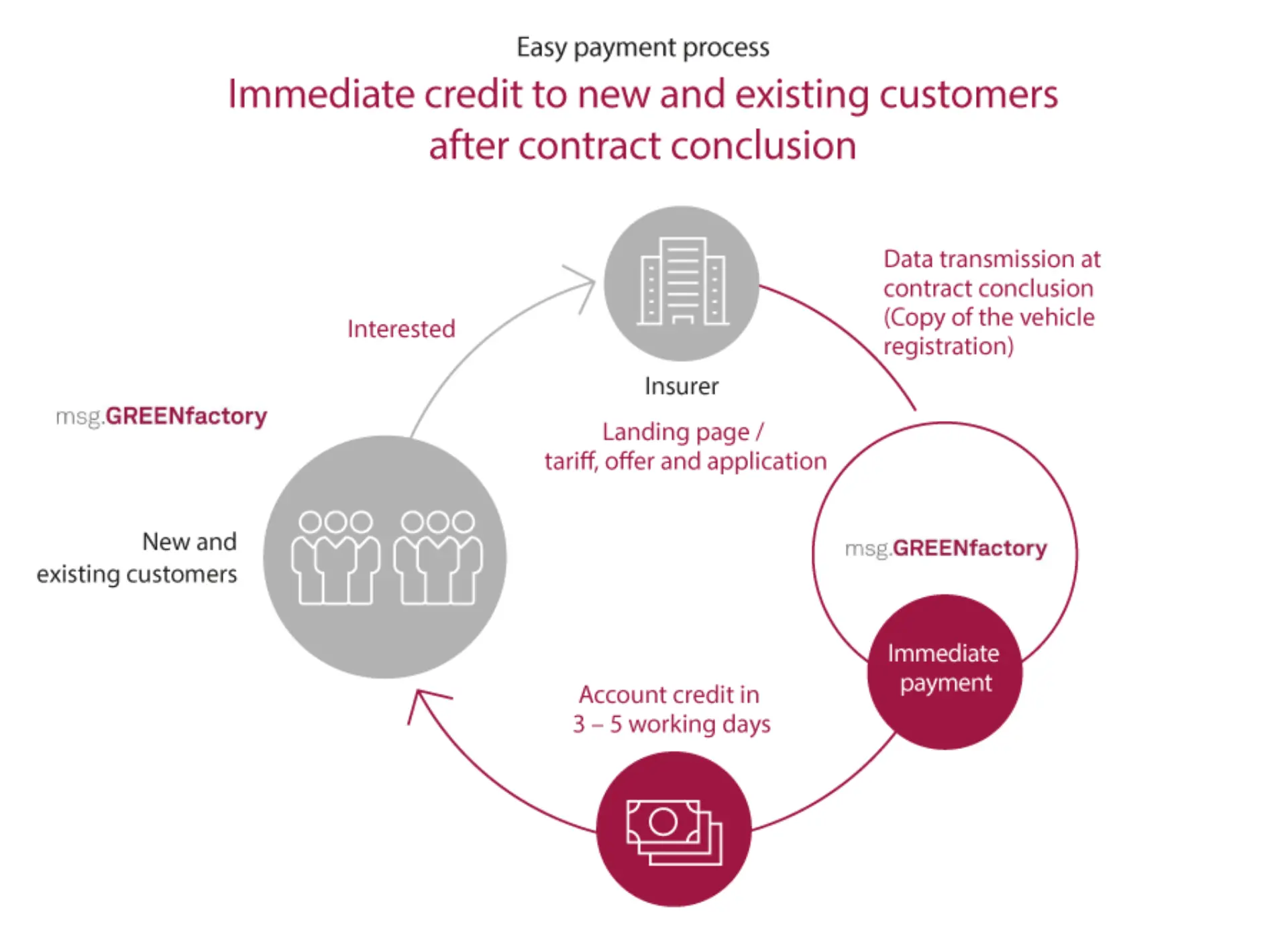

- Immediate payment irrespective of the confirmation by German Federal Environment Agency

- Attractive long-term returns

- High level of planning reliability due to fixed trading partners

- High level of customer acceptance

- Orchestration of the overall processes – from the product development to the quota trade via an exclusive quota buyer network

- Minimum effort

- Go2Market within 6 weeks

- Strong external visibility as an active partner on the topic of sustainability

- Contribution to a better climate balance

- Reduction of your own ecological footprint

- Your customer remains your customer

- No customer routing to external platforms

- Full control of customer touchpoints

- No external customer approach

- Partner in the background

- Ready-to-use plug & play solutions from tariff, offer and application up to the landing page

- Absolute transparency via the customer dashboard

- Detailed process tracing and fast accounting